-

Seoul shares open lower despite overnight US gains

South Korean stocks opened lower Thursday, despite overnight US gains. The benchmark Korea Composite Stock Price Index lost 29.24 points, or 0.72 percent, to 4,007.06 in the first 15 minutes of trading. Overnight, Wall Street closed higher on hopes that the Federal Reserve will cut interest rates next week. The S&P 500 added 0.3 percent, and the Dow Jones Industrial Average was up 0.86 percent while the tech-heavy Nasdaq composite was 0.17 percent higher. In Seoul, most-large cap shares traded l

Dec. 4, 2025 -

Seoul shares up over 1% on positive Q3 GDP report; won rises slightly

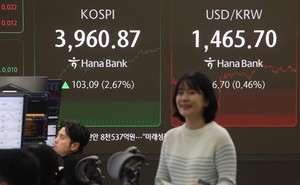

Seoul shares shot up more than 1 percent to close above the 4,000 point mark Wednesday as investors' sentiment was boosted after the Bank of Korea said the economy expanded at the fastest pace in nearly four years in the third quarter on strong exports. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index added 41.37 points, or 1.04 percent, to close at 4,036.3. It was the first time the index finished above 4,000 since Nov. 20. Trade volume was low at 286 m

Dec. 3, 2025 -

Seoul shares open slightly higher on Wall Street gains

South Korean stocks opened slightly higher Wednesday tracking overnight gains on Wall Street led by improved appetite for tech shares. The benchmark Korea Composite Stock Price Index added 3.72 points, or 0.09 percent, to 3,998.65 in the first 15 minutes of trading. Overnight on Wall Street, the S&P 500 added 0.25 percent, and the Dow Jones Industrial Average gained 0.39 percent. The tech-heavy Nasdaq composite increased 0.59 percent. In Seoul, top tech giant Samsung Electronics rose 1.16 percen

Dec. 3, 2025 -

Seoul shares end almost 2% higher on chip, auto gains

South Korean stocks closed sharply higher Tuesday, snapping a three-day losing streak, buoyed by gains in major chipmakers and automakers, as the United States has confirmed that tariff rates on imports from Seoul would be lowered to 15 percent retroactively. The Korean won increased against the US dollar. The benchmark Korea Composite Stock Price Index added 74.56 points, or 1.9 percent, to close at 3,994.93. Trade volume was moderate at 315.13 million shares worth 12.23 trillion won ($8.32 bil

Dec. 2, 2025 -

Seoul shares open sharply higher despite overnight US losses

South Korean stocks opened sharply higher Tuesday, jumping nearly 1 percent, despite overnight US losses. The benchmark Korea Composite Stock Price Index added 38.52 points, or 0.98 percent, to 3,958.89 in the first 15 minutes of trading. Overnight, Wall Street gave back some of last week's rally as Bitcoin fell again. The S&P 500 slipped 0.2 percent, and the Dow Jones Industrial Average was down 0.5 percent while the tech-heavy Nasdaq composite was 0.2 percent lower. In Seoul, most-large cap sh

Dec. 2, 2025 -

Seoul shares end almost flat on profit-taking amid uncertainties

South Korean stocks closed almost unchanged Monday as investors sought profits amid increased uncertainties. The Korean won increased against the US dollar. After a choppy session, the benchmark Korea Composite Stock Price Index went down 6.22 points, or 0.16 percent, to close at 3,920.37. Trade volume was thin at 293.7 million shares worth 11.69 trillion won ($7.95 billion), with winners beating losers 489 to 380. Foreign and individual investors purchased a net 215.4 billion won and 52.8 billi

Dec. 1, 2025 -

Seoul shares open higher on US gains

South Korean stocks opened higher Monday, tracking US gains. The benchmark Korea Composite Stock Price Index added 10.14 points, or 0.26 percent, to 4,002.82 in the first 15 minutes of trading. On Friday (local time), Wall Street closed broadly higher, extending its winning streak to a fifth day amid the Thanksgiving holiday. The S&P 500 rose 0.54 percent, the Dow Jones Industrial Average gained 0.61 percent, and the tech-heavy Nasdaq composite climbed 0.65 percent. In Seoul, most large-cap shar

Dec. 1, 2025 -

Seoul shares snap 3-day rally; won sharply down

South Korean stocks fell by 1.5 percent Friday to end a three-day winning streak as investors sought profits. The Korean won declined sharply against the US dollar. The benchmark Korea Composite Stock Price Index lost 60.32 points, or 1.51 percent, to close at 3,926.59. The index had risen for three sessions in a row from Tuesday to Thursday. Trade volume was light at 237.7 million shares worth 11.7 trillion won ($8 billion), with winners outpacing decliners 592 to 281. Foreigners dumped a net 2

Nov. 28, 2025 -

Mirae Asset’s physical gold ETF gains traction amid gold, crypto rush

As global demand for safe-haven gold and alternative assets such as cryptocurrencies continues to surge, Mirae Asset Global Investments’ physical gold exchange-traded fund, or ETF, is drawing increased interest in the Australian market. Global X Australia -- formerly called ETF Securities and acquired by Mirae Asset in 2022 -- launched the world’s first physical gold ETF, Global X Physical Gold, in 2003. As of Nov. 20, the fund’s net assets stood at $5.97 billion. The firm is credited with popul

Nov. 28, 2025 -

Seoul shares open lower on tech, financial losses

South Korean stocks opened lower Friday on losses from tech and shipbuilding shares. The benchmark Korea Composite Stock Price Index lost 21.51 points, or 0.54 percent, to 3,965.4 in the first 15 minutes of trading. The US stock market closed on the Thanksgiving Day holiday. In Seoul, tech giant Samsung Electronics fell 1.55 percent, and its chipmaking rival SK hynix retreated 0.92 percent. HD Korea Shipbuilding & Offshore Engineering declined 1.76 percent, and Hanwha Ocean dropped 1.45 percent.

Nov. 28, 2025 -

Seoul shares up for 3rd day on US rate cut hope

South Korean stocks closed higher for a third consecutive session Thursday, boosted by hopes for a rate cut in the United States. The local currency was trading almost unchanged against the US dollar. The benchmark Korea Composite Stock Price Index added 26.04 points, or 0.66 percent, to close at 3,986.91. Trade volume was moderate at 251.6 million shares worth 12.85 trillion won ($8.77 billion), with winners outpacing decliners 482 to 389. Foreigners and institutions purchased a net 149.6 billi

Nov. 27, 2025 -

Seoul shares open sharply higher on US gains

South Korean stocks opened sharply higher Thursday, jumping more than 1 percent, tracking overnight US gains on growing expectations of interest-rate cuts. The benchmark Korea Composite Stock Price Index added 41.95 points, or 1.06 percent, to 4,002.82 in the first 15 minutes of trading. The market returned to the 4,000 level for the first time since Nov. 20, after five trading days. On Wednesday (local time), Wall Street closed broadly higher, extending its winning streak to a fourth day as inv

Nov. 27, 2025 -

BOK holds key rate steady for 4th consecutive session amid FX volatility

South Korea's central bank kept its benchmark interest rate unchanged Thursday to safeguard financial stability amid a weakened local currency and an unstable housing market. In a widely expected decision, the Monetary Policy Board of the Bank of Korea kept the key rate steady at 2.5 percent at its rate-setting meeting in Seoul. It marked the fourth straight on-hold decision, even as the central bank remains in an easing cycle. Since October last year, the BOK has cut the key rate by a cumulativ

Nov. 27, 2025 -

Seoul shares rise over 2% amid rate cut hopes; won sharply rises

South Korean stocks rose by more than 2 percent Wednesday as foreign investors scooped up shares on continued hopes for a rate cut in the United States and the stabilized foreign exchange market. The Korean won fell sharply against the US dollar following Finance Minister Koo Yun-cheol's pledge to take "decisive action" against excessive volatility in the won-dollar rate. The remark followed the National Pension Service's participation in a consultative body that oversees the FX market, which ha

Nov. 26, 2025 -

NPS now biggest force in FX market: finance minister

South Korea is tightening oversight of the National Pension Service’s growing sway over currency markets, unveiling a new four-way working group to monitor the long-term effects of the fund’s investment on the won. “The NPS has the single largest presence in the foreign-exchange market,” Finance Minister Koo Yun-cheol said at a briefing Wednesday. “When the fund undertakes large overseas investments in a short period relative to the size of the FX market, it can fuel price pressures and erode re

Nov. 26, 2025